LATEST STUDENT LOAN NEWS

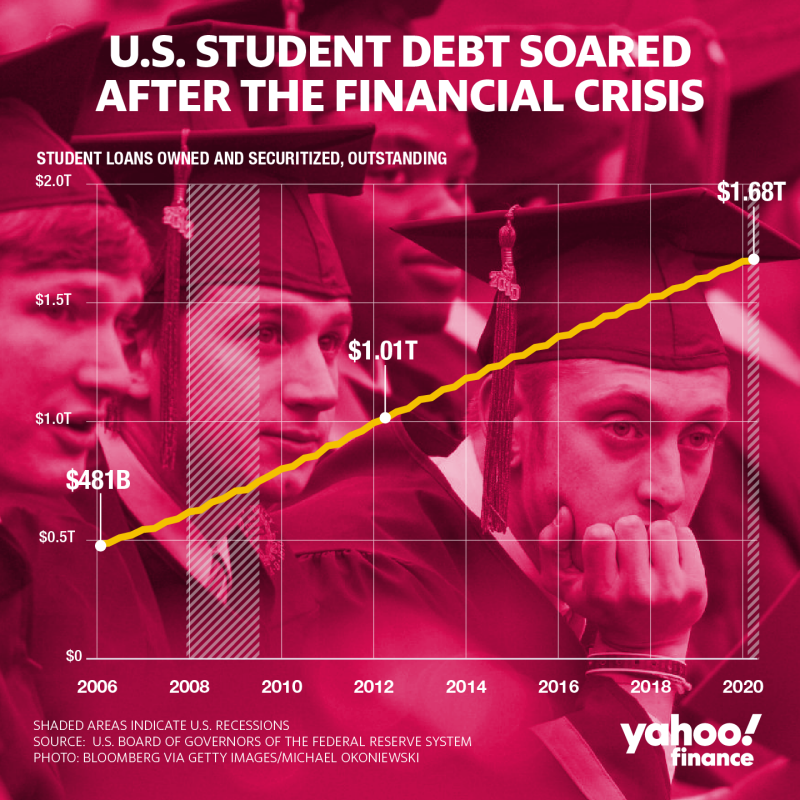

Fixing the $1.68 trillion student debt crisis in America is the responsibility of the government, according to one expert.

“This is a federal government problem and it can be addressed with a federal solution,” Ashley Harrington, federal advocacy director and senior counsel at the Center for Responsible Lending, told Yahoo Finance’s The Ticker.

Harrington, who made those comments in response to a proposal by Democratic Senators Chuck Schumer and Elizabeth Warren to the next president of the U.S. to cancel $50,000 in student loan debt for borrowers, is part of the coalition that believes erasure is the only path forward.

“It’s about the way the entire system was set up,” she added, referring to the inherent issues in the current system. “We’ve gotta move towards… debt-free college.”

‘We’re just kicking the can down the road’

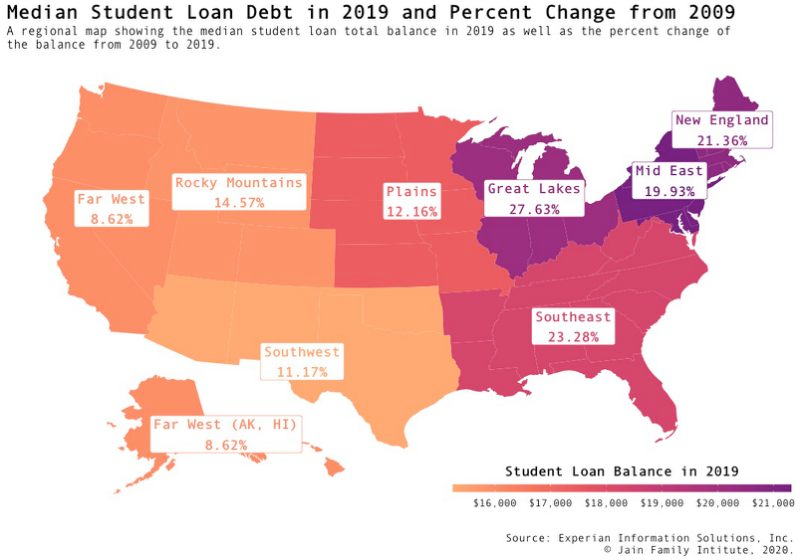

Student loans are becoming a major campaign issue this election as Americans graduate college with heavier burdens: Between 2009 and 2019, student loan borrowers between 18 and 35 have seen their median total debt balance grow by nearly 18%, according to a new report by the Jain Family Institute.

In particular, “Black and brown borrowers are struggling the most because of our history of structural inequities and discrimination,” Harrington added.

The Jain Institute authors noted that their research showed borrowers living in zip codes where the population was mostly Black, median balances have increased over the decade by 54%. Majority-Hispanic zip codes saw a 43% increase in balances.

Additionally, majority-Black neighborhoods with the highest median debt balance of $19,485 were dominated by for-profit colleges. The findings are consistent with other reports.

More broadly, in the lowest-income neighborhoods, the authors found that debt-to-income ratios had increased from 56% in 2009 to 94% in 2018.

Overall, broad cancellation is “going to disproportionately impact black and brown borrowers automatically,” said Harrington.

Even though President Donald Trump’s recent executive order suspended interest from accruing on student loans, allowing borrowers to stop repayment without penalty until 2021, the problem is still unresolved.

“We’re just kicking the can down the road,” Harrington said. “Unless we do something about balances… then we haven’t truly addressed this crisis.”